Solutions to Banker Rule: Key Monetary Conferences Slated for Fall 2025 in Canada, Chicago

STOP THE PRESSES!

ROUGEMONT, Canada–The Pilgrims of Saint Michael (www.MichaelJournal.org) will hold their 2025 Social Credit Economics Congress Aug. 27 thru Sept. 2 at the Louis Even Institute near Montreal in Rougemont, Quebec—as this Catholic lay group continues to study and lay the groundwork to implement the sweeping monetary reform known as social credit (which is in no way related to China’s so-called “social credit” surveillance and social rewards-and-punishment system).

The target: The interest-bearing, outrageously dysfunctional money system that is enslaving mankind. The 2025 schedule involves the following:

>> A “Congress” on Social Credit, including speakers and special attendees, Sat.-Sun., Aug. 30-31. A special trip to Montreal is slated for Mon., Sept. 1.

“You can only obtain what you can pay for. In the face of abundant production, there should be an abundance of purchasing power, of money in the wallets of the people,” Louis Even (1885-1974) himself wrote in the days that he promoted and wrote about social credit economics as the leader of Pilgrims of St. Michael (www.MichaelJournal.org), also known as the White Berets.

Even added:

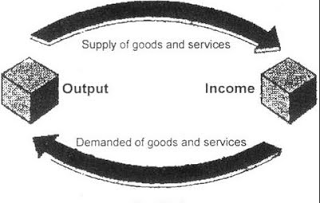

The reality of the current system is that the total price of the finished goods is always higher than the amount of money distributed as purchasing power in the course of their production. The capacity to pay is not made equal to the capacity to produce.” (See graphic below)

Social credit essentially involves governments reclaiming the sovereign power of creating money interest-free in amounts that are in harmony with the nation’s production level, so as to avoid creating currency above and beyond productive output; this, in turn, avoids demand-pull inflation. It’s designed to pay a national dividend to all citizens by virtue of their citizenship, with the amount based on the production data; this dividend is separate from employment earnings and is not tax-funded welfare. Another component, the compensated discount, is a dividend to businesses in the form of a rebate—like a reverse sales tax.

It compensates them for price rollbacks to ensure inflation is prevented, and to make sure buying power stays in harmony with prices.

Under social credit, money is spent into circulation, rather than borrowed into existence with interest; then, it’s directly issued to citizens on a regular basis. Each person can seek employment to supplement their dividend. This foundational dividend income, with a debt-free currency, cannot create debt. Taxes and welfare would become rare or non-existent over time.

CHICAGO-BASED GROUP PLANS VIRTUAL CONFERENCE

NEWS BULLETIN / ONLINE VIRTUAL CONFERENCE—Please join the 21st Annual American Monetary Institute (AMI) Conference from Sept 19-21 and 26-28. Fridays from 6 – 10 pm, and Saturdays & Sundays from 9 am – 1 pm (CDT / UTC -5). The conference page and the registration page are under construction. Go to www.Monetary.org. See top of the home page and enter your email address to receive updates.

Mr. Steven Walsh of Evanston, Ill. is the chief organizer and moderator. Notably, “Social Credit Economics” author Oliver Heydorn (www.Socred.org) will speak at AMI’s virtual conference.

“It’s evident that true [monetary] reform, not mere regulation, is necessary to move humanity . . . away from a world dominated by fraud, warfare and ugliness and toward . . . justice and beauty . . . we urge you to avoid discouragement and instead join with us in this adventure to achieve positive results for America and the world,” an online posting from a past AMI conference stated.

—————————

EDITOR’S NOTE: See the Pilgrims of St. Michael’s website at www.MichaelJournal.org. To read their “MICHAEL” journal, see the website or write to Michael Journal, 1101 Principale St., Rougemont, QC, Canada, J0L 1M0 (J zero L 1M zero). To call Rougemont, dial (450) 469-2209. Email is mail@michaeljournal.org.