Raising Interest Rates Akin to Giving Patient ‘Chemo’: Which Dies First, Inflation or the Economy?

By Mark Anderson

STOP THE PRESSES! News Association

When the Federal Reserve on July 26 approved a widely expected interest rate hike that moved benchmark borrowing costs to their highest level in more than 22 years—the 11th rate increase since the Fed launched its “fight against inflation” in March 2022—it continued peddling the notion that price inflation is an external force over which the Fed has no direct control. Price inflation is referred to as if it’s an earthquake or a thunderstorm, or perhaps a capricious dragon bent on destruction, patiently stewing in its lair, just waiting to pounce.

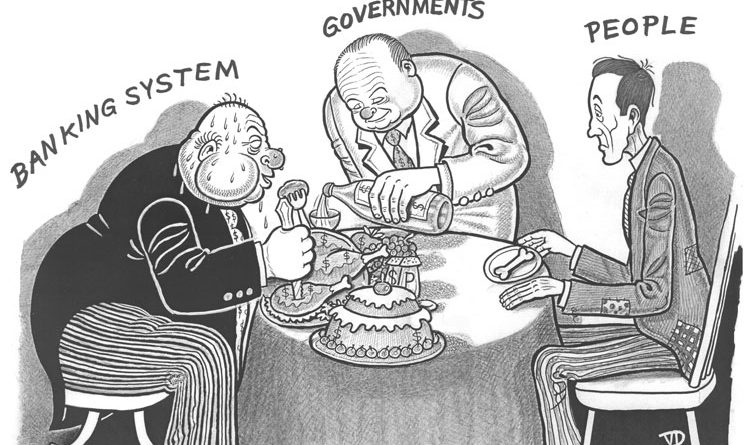

The basic assumption is that the Fed is looking out for the American people by valiantly trying to slay this dodgy “price inflation” dragon. But what if that “dragon” is of the Fed’s own making?

This writer asked three noted non-establishment monetary-reform experts about this matter: Dick Eastman, who studied doctoral macroeconomics under Akira Takyama at Texas A & M and taught at the community college level in Washington state; Dr. Oliver Heydorn, a lecturer and author of “Social Credit Economics” (no relation whatsoever to China’s monetary-social conformity scheme—Editor’s note) and author Mickey Paoletta, a longtime self-taught authority on the Fed, and investigator-activist exposing the nation’s mortgage-foreclosure racket.

Eastman remarked: “Raising the interest rate drains money from consumers, from the real economy. Those with variable interest rates will have less to spend than previously, and that reduction of money in circulation will go around reducing everyone’s revenues, spending, hiring, debt-paying-capacity etc., significantly. This is definitely money deflation, which is the reduction of money in circulation when people borrow less or are loaned less.”

“All I can say,” Paoletta noted, when asked about the Fed citing rate hikes as a surefire way to contain prices, “is that claim by the Fed is so ironic and so wrong that I don’t see how they can look at themselves in the mirror.”

Asked whether raising interest rates will simply become another cost of doing business that’s passed on to the end consumer, Paoletta replied:

I agree with that 100%. And it’s a roadblock for people to start a business as lines of credit and loans become more expensive—a price increase in itself.” — Mickey Paoletta, Mechanicsburg, Penn.

Will raising rates protect established corporations that possess much more monetary muscle than smaller businesses?

“Maybe that’s what the Fed wants,” Paoletta remarked.

Heydorn noted: “Basically, the raising of interest rates to ‘fight inflation’ is akin to using chemotherapy to treat cancer in allopathic medicine. Just as chemotherapy involves injecting someone with poison in the hope that it will kill the cancer before it kills the patient, so too, increasing interest rates sickens the economy.”

Heydorn added: “As the economy stalls and consumers can no longer afford the accustomed standard of living, private businesses are forced to subsidize the consumer by absorbing some of the costs of production in order to stay in business. Prices come down or at least the rate of inflation is tamed, but this comes at the cost of bankruptcies, the cutting or elimination of profit margins, etc.”

Eastman stressed that Powell is actually “decreasing money in the real economy by increasing interest rates to supposedly fight [price] inflation,” even while he is giving more money to the creditor class to invest. “Does raising interest rates and increasing money in the hands of investors at the expense of consumers really fight price inflation? No. Because, contrary to popular belief, the problem with inflation NEVER WAS THAT MORE AND MORE PRINTING PRESS MONEY IS CHASING A FIXED AMOUNT OF GOODS, FORCING UP THE PRICE. That’s not happening.”

Most importantly, Eastman explained:

Less money means less sales. When less is sold, a firm’s revenues fall. While having to meet fixed costs . . . the firm must raise prices on goods even though they are selling fewer units—because bank credit, among other costs, including higher interest charges, simply must be paid back.” — Dick Eastman, Yakima, Washington.

“So,” Eastman summarized, “customers must pay more per unit sold, or do without certain goods. That’s how deflation can cause firms to raise prices; they do it just to keep the customers who can pay the new price.”