COVERING FOR THE BANKERS: Quack Economists a Barrier to Humanity’s True Inheritance

Video & Story Below: Monetary analyst nails “experts” for betraying the public, fostering poverty

By The TRUTH HOUND

While corporate media claim “fake news” is the exclusive product of amateur bloggers and dreaded “conspiracists,” we rarely hear about the fakery of economists.

Economists, long assumed to be stuffy but harmless nerds not given to flights of fancy, let alone underhandedness, are perhaps an even bigger failure than the big media. And that’s saying something.

But just as most big media have supported the many wars that have virtually bankrupted a clear majority of humanity—a process which started in earnest with the competition between publishers Joseph Pulitzer and William Randolph Hearst to scare the U.S. into the Spanish-American War under fake pretenses—economists have helped fasten upon society a deplorable economic system.

And the poverty that stems from this system immerses nations in blue- and white-collar crime, chronic financial instability, and many other economically-induced social ills.

As the decades have rolled by, Mr. Keynes, Mr. Hayek, Mr. Krugman and other economics “masterminds” have scribbled their formulas on chalk boards, written their papers and columns, and given their speeches.

But all we get, from the classroom to the business pages, is a ticket to nowhere called orthodox economics, which imprisons us in a false paradigm: The socialist “Keynesian” school is to “the left” and the alleged “conservative alternative,” the Austrian School, is to “the right.” What else is there?

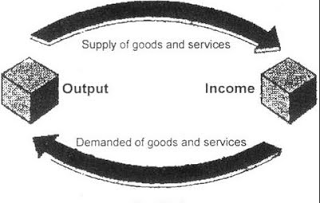

Well, a crystal-clear video overview of the failure of economists to show us a different way just arrived in my email from Robert Klinck, an economics speaker and activist from Alberta whose brother Wallace shares his deep knowledge of economics, especially in naming a key accountancy defect of the current economic system: A shortfall of purchasing power so huge that each production cycle fails to be liquidated. Constant production for its own sake only builds inventories and price structures far faster and far in excess of work income. That’s a mathematical reality, not an ideology.

The remedy: New money is needed to boost demand in the present, instead of going into debt and mortgaging the future to pay for things in the present.” — The TRUTH HOUND

But the late “court” economist Mr. John Maynard Keynes, “Upon being told there might be a shortage of buying power in the hands of the public . . . said perhaps a solution would be for the government to bury cash in coal mines, so people could go and dig it up and thereby supplement their income,” Klinck says.

Such pomposity is fairly typical of past and present mainstream economists who “have failed in their responsibilities to society because they have completely ignored the progress of the industrial arts—which have brought us to a situation of such potential abundance that it would be the stuff of dreams for earlier generations,” Klinck adds.

Thus, our vast accumulation of practical knowledge and applied science over generations has elevated us to a place where we can “deliver goods in profusion and give everyone a good life” with far less stress and effort.

That’s because, as highly efficient automated production advances, there is a corresponding reduction in the need for obligatory human labor to produce most goods. But if automation takes center stage, how do people make a living?

The answer resides in a monetary-financial reformation called “social credit,” which I’ve touched on before.

It calls for paying everyone an unconditional allowance, or dividend (from a publicly controlled issuance of interest-free new money that is NOT a debt to repay) to supplement working income, but also to recognize the reduced need for human labor in production.

The dividend’s amount, to avoid excess, is gauged to productive output whether by machine or human hands. Even if automation increases, so, too, does the dividend.

The goal is to finally allow centuries of industrial-arts progress to give all people a break from being overworked and instead introduce much more leisure time—but with a stable and increasing income and a downward price trend, too.

That, according to scores of suppressed rebel economists, academics and authors, is how we end the paradox of time but no money, and money but no time. Especially see the work of Dr. Oliver Heydorn at www.socred.org

The financiers at the top want to keep everyone hooked on usurious loans and credit cards, like drug dealers who need addicts. “Reverse mortgages” and other buggery also are being peddled to try and fill the “gap” between stunted purchasing power and towering price-and-debt structures.

“The economists,” Klinck summarizes, “have functioned basically as the hand-maiden of the money power and in this respect they have betrayed their fellow citizens. . . . The last thing the financiers controlling this system want is for people to begin questioning why the productive system is so advanced but the reality of their daily lives barely changes in the context of this tremendous technological progress.”